Time & distance: Looking for affordability, Vancouver homebuyers can either look a decade in the past or 100 kilometres to the east

One real estate sale at a time, those who won the housing lottery in cities west of Chilliwack are moving east and cashing in

Everyone in B.C. who rents or owns is acutely aware of the housing affordability crisis in just about every corner of the Lower Mainland.

And anyone who purchased a property before 2016 is either rubbing their hands with glee or is quietly ashamed of their good fortune because they purchased something that's now worth twice what they could afford if they had to buy it today.

The last decade saw double-digit percentage increases in prices in Vancouver and triple-digit in Chilliwack, but with starting points so much lower, the Eastern Fraser Valley is still a "good" deal, relatively speaking.

There’s nothing scientific about comparing one home in one community to something sort of similar in another community because many factors affect prices.

Anecdotally, if people in Vancouver catch a glimpse of what homes are valued at and selling for in Chilliwack and vice versa, folks might be gobsmacked.

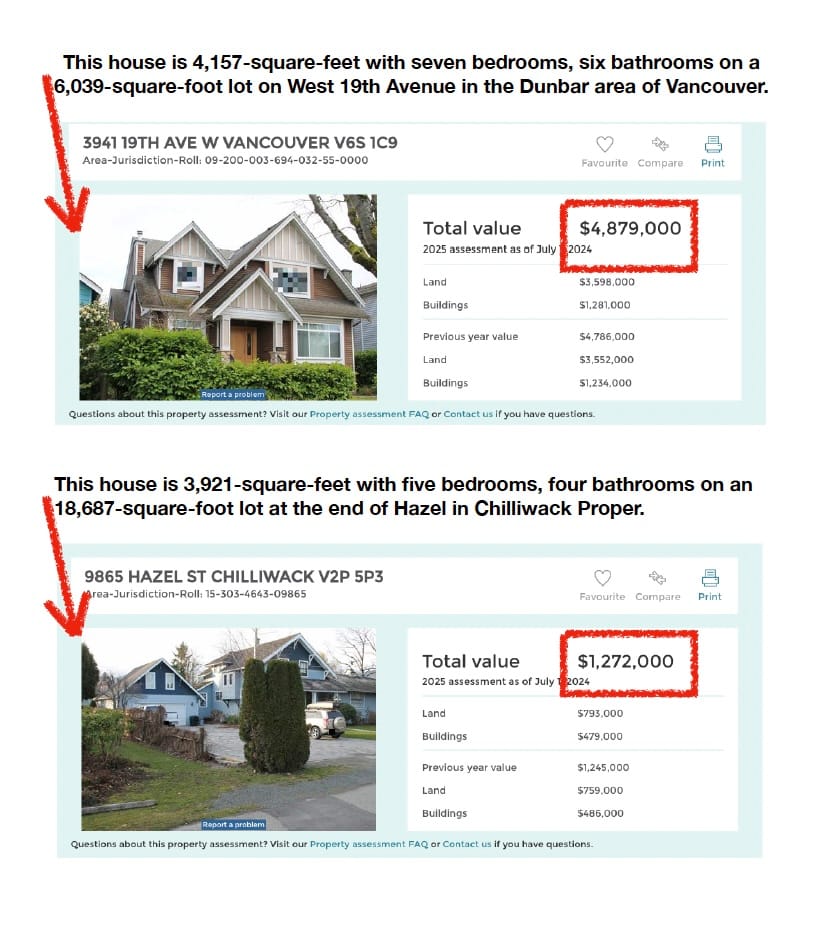

Take two single-family homes in each city that, at least on paper, share similarities yet have shockingly different price tags. Both are in nice neighbourhoods in Chilliwack and Vancouver with similar square footage and design styles.

Chilliwack: 9865 Hazel St. is the northernmost property on Hazel off Riverside Drive next to the Hope Slough, an approximately 4,000-square-foot house on a massive lot.

Vancouver: 3941 West 19th Ave. is in the exclusive Dunbar neighbourhood, a similar-sized house on a lot one-third the size of the Chilliwack Hazel house.

The BC Assessment valuation difference: $1.3 million versus $4.9 million. The Vancouver property is much newer, a little larger, but on a 6,000-square-foot lot compared to Chilliwack’s on 18,700 square feet and the former is four times the price.

Comparing apples to oranges

The benchmark price of all homes – houses, townhouses, apartments – in Vancouver last month was $1.17 million.

Those living in the largest city in the province need to look a decade in the past or down Highway 1 to see anything vaguely affordable compared to that. A decade ago, the benchmark price of a home in Vancouver was $694,000. In Chilliwack last month, it was $759,500.

Chilliwack’s a decade ago was $343,000.

Two examples pulled out of a hat, and by a hat I mean former city councillor and realtor Mark Andersen’s listings from the June 2014 edition of the local paper.

Andersen had 6052 Lindeman St. in Promontory listed for $399,000, and 46379 Angela Ave. closer to downtown listed for $277,900 in 2014. In 2024, the assessed values of those houses were $966,000 and $749,000 respectively, staggering increases of 142 per cent and 170 per cent.

Apples and oranges indeed. Vancouver’s benchmark rose 69 per cent in a decade while Chilliwack’s rose 121 per cent yet the entire Eastern Fraser Valley is still comparatively affordable for big city folk.

A million-dollar drive

I went to Vancouver recently to see a friend and did some highly unscientific real estate research. I picked a figure of just over $1 million and found places for sale for that price relatively near to Highway 1 in Abbotsford, Langley, Surrey, Coquitlam, and Burnaby, as well as one each not necessarily near the highway in Vancouver and Chilliwack.

What can you get for a million dollars? Needless to say less and less the further west you drive.

In Chilliwack I picked a nice home on Little Mountain with views of the valley. In Abbotsford a nice little house on Conway Place near the downtown.

In Langley, Surrey, Coquitlam and Burnaby they were townhouses that got progressively smaller in size the further west I went go. In Surrey, the property is relatively new but the location is questionable, literally right next to the highway acoustic barrier.

And in Vancouver I found an apartment in Kitsilano, a 1,000-square-foot, two-bedroom penthouse.

How much will my million-dollar home cost me?

As laid out in my last real estate story about real-estate unattainability, if you already know this you already know this, but if you don’t know this you’re not going to like it.

The minimum down payment on a $1 million home is 7.5% or $75,000 – 5% on the first $500,000, 10% on the rest.

CMHC insurance is $37,000 so you are left with a $962,000 mortgage.

If $75,000 sounds like a lot of money to have saved up, hold on, don’t forget: land transfer tax $18,000, lawyer fees $1,000, title insurance $900, home inspection $500, and appraisal fees $300. That’s 20,700 + $75,000 = $95,700.

Your monthly mortgage payment based on a four per cent interest rate (on the low end for a five-year term right now) is $5,060 plus some ballpark expenses: property tax $685, utilities $185, property insurance $50, phone/cable/internet $200. That’s all about $6,200 per month.

To get in the door of a $1 million home, a first-time homebuyer needs $100,000 to start and more than $6,000 a month in housing costs. If we go with the old rule that you shouldn’t be spending more than 30 per cent of your income on housing, which is of course ridiculous these days, and we round that up to and that means you need to make more than $18,000 a month or $216,000 a year, which for a couple without kids is certainly doable but well above average or "normal."

(Source: Realtor.ca mortgage calculator)

-30-

Want to support independent journalism?

Consider becoming a paid subscriber or make a one-time donation so I can continue this work.

Paul J. Henderson

pauljhenderson@gmail.com

facebook.com/PaulJHendersonJournalist

instagram.com/wordsarehard_pjh

x.com/PeeJayAitch

wordsarehard-pjh.bsky.social