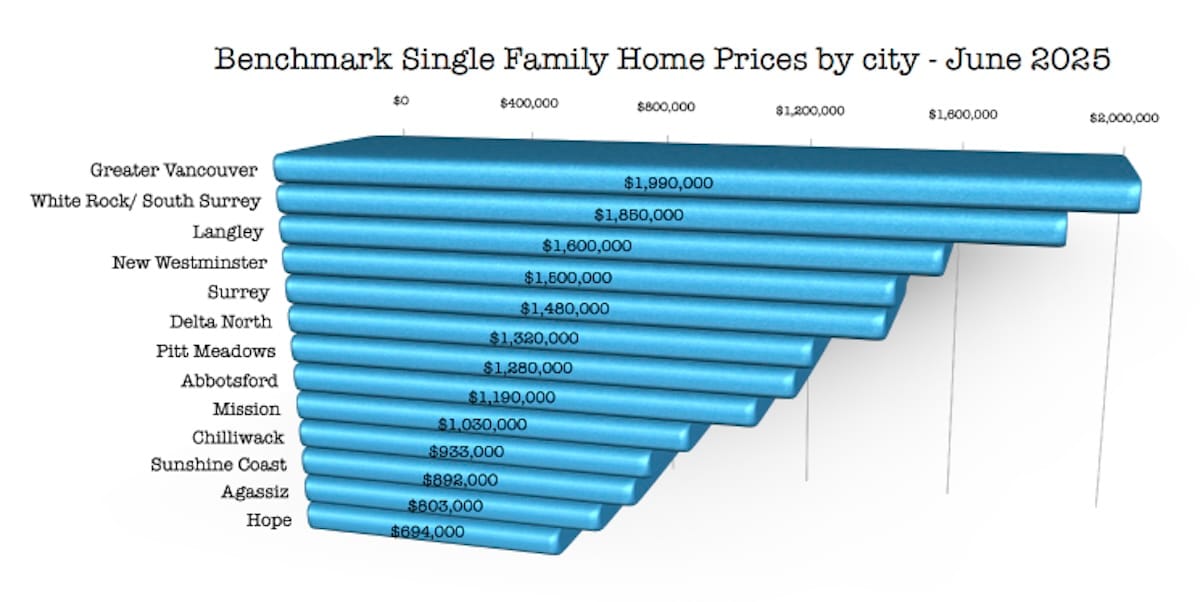

Real estate unattainability: First-time home ownership is near impossible anywhere from Vancouver to Hope

Lower Mainland real estate boards ponder global uncertainty, lagging sales, momentum shifts, all amid increasingly ridiculous home prices

For anyone cynical about weather forecasters, real estate prognosticators can be next-level fuzzy fortune tellers in a world of financial uncertainty such as exists in 2025.

What are the real estate boards in the Lower Mainland saying to give buyers and sellers confidence?

“For buyers who can tolerate the current economic uncertainty, this market offers some very real opportunities,” that from the chair of the Fraser Valley Real Estate Board (FVREB*) Tore Jacobsen.

Not sure how many people can tolerate economic uncertainty for what is likely the largest purchase of their lives.

"Although home sales were only just above levels from the same month last year, June marked a departure from the declining monthly trend that began in early 2025,” according to Chilliwack and District Real Estate Board (CADREB**) president Emily Vernon, adding: “Right now, it’s too early to tell if this is the beginning of momentum that will get us back on track to more solid activity or just a one-off.”

A departure from the decline may or may not mean a rise. Follow?

Let’s see how Greater Vancouver Real Estate Board (GVREB***) director of economics and data analytics clarifies the situation.

“On a trended basis, signs are emerging that sales activity is rounding the corner after a challenging first half to the year, with the year-over-year decline in sales in June halving the decline we saw in May,” Andrew Lis said in the GVREB’s news release. “If this momentum continues, it may not be long before sales are up year-over-year, which would mark a shift toward a market with more demand than the unusually low demand we’ve seen so far this year.”

Read that at least one more time.

To summarize, the GVREB says that what just happened wasn’t as bad as it was just before that so it might not be long before it’s better than it’s been.

The FVREB says, for those who are good with uncertainty, now’s the time to be decisive.

And CADREB says, the 2025 trend may have finally shifted. Unless it hasn’t.

While these might be slightly unfair (and sarcastic) summaries, real estate board representatives have to say something publicly as they do every month as leaders in a usually uncertain industry in the most uncertain of times.

They are standing in the eye of a hurricane asked to predict where a barn might land.

* FVREB covers Abbotsford, Langley, Mission, North Delta, Surrey, and White Rock.

**CADREB covers Chilliwack, Agassiz, Hope, Boston Bar and Harrison.

*** GVREB covers Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

A few simple facts about June 2025 real estate sales:

• 2,181 homes sold in Greater Vancouver, down 10 per cent year over year and 26 per cent below the 10-year seasonal average

• 1,195 homes in the Fraser Valley, down nine per cent year over year and 33 per cent below the 10-year seasonal average

• 254 homes in Chilliwack was a small increase of 2.4 per cent year over year but still 22 per cent below the 10-year seasonal average

More and more people are moving to British Columbia and particularly the Lower Mainland. More and more housing is being built but home sales are down, down, down. Why? Mostly because of this:

• $1.2 million is the benchmark price of all homes, apartments, townhouses, single-family homes, in Greater Vancouver. For detached homes it is $1.8 million

• $950,000 is the benchmark in the Fraser Valley for all housing types and it is $1,5 million for houses

• $769,000 is the benchmark for all homes in Chilliwack, $933,000 for detached houses.

(See below for a fun calculation on what your $1 million home will cost you.)

Focusing on the latter, much smaller market, Chilliwack has the lowest average home prices of any medium-sized city in the Lower Mainland by a long shot yet prices have risen 245 per cent in 20 years. In 2005, the average single-family home price was approximately $290,000. In 2025, it's $990,000.

Two decades is a really long time so how about just 10 years. Prices in Chilliwack rose 165 per cent between 2015’s average single-family home selling price of $373,000 up to last month at just under a million bucks.

Let’s be honest: No first-time homebuyer in any community in the Lower Mainland can get enough money together for a down payment to purchase a home of any kind without help from family, an inheritance, a lottery win, or wealth from abroad.

The only ones purchasing homes in Chilliwack are in this latter category, moving from within the region, or people moving from the Fraser Valley board area or Vancouver. The only ones purchasing homes in the Fraser Valley are this unusually wealthy class or people moving laterally or from Vancouver.And the only ones purchasing in Vancouver already live there or have an external wealth source outside of income.

I’ll leave the last words to the representatives as quoted in the monthly news releases from the three Lower Mainland boards issued a few days ago.

“With over 17,000 listings on the market right now, and with mortgage rates down around two per cent since last summer, buyers are enjoying some of the most favourable conditions seen in years,” according to Lis from the GVREB.

"New supply is still declining as sellers are pulling back from the recent peak activity at the beginning of the year, which should hopefully allow the market to move away from buyer’s territory and back to the lower end of a more balanced position,” said Vernon from CADREB.

“With more homes to choose from and softening prices, it’s a uniquely favourable time to make a move in the Fraser Valley, particularly for first-time buyers.”

That from FVREB president Tore Jacobsen, presumably with a straight face.

How much will my million-dollar home cost me?

If you already know this, you already know this but if you don’t know this you’re not going to like it.

The minimum down payment on a $1 million home is 7.5% or $75,000 – 5% on the first $500,000, 10% on the rest.

CMHC insurance is $37,000 so you are left with a $962,000 mortgage.

If $75,000 sounds like a lot of money to have saved up, hold on, don’t forget: land transfer tax $18,000, lawyer fees $1,000, title insurance $900, home inspection $500, and appraisal fees $300. That’s 20,700 + $75,000 = $95,700.

Your monthly mortgage payment based on 4% interest rate (on the low end for a five-year term right now) is $5,060 plus some ballpark expensees: property tax $685, utilities $185, property insurance $50, phone/cable/internet $200. That’s all about $6,200 per month.

To get in the door of a $1 million home, a first-time homebuyer needs $100,000 to start and more than $6,000 a month in housing costs. If we go with the old rule that you shouldn’t be spending more than 30 per cent of your income on housing, which is of course ridiculous these days, and we round that up to and that means you need to make more than $18,000 a month or $216,000 a year.

(Source: Realtor.ca mortgage calculator)

-30-

Want to support independent journalism?

Consider becoming a paid subscriber or make a one-time donation so I can continue this work.

Paul J. Henderson

pauljhenderson@gmail.com

facebook.com/PaulJHendersonJournalist

instagram.com/wordsarehard_pjh

x.com/PeeJayAitch

wordsarehard-pjh.bsky.social